The esports industry presents a unique opportunity for collaboration with a diverse set of business sectors as it grows exponentially. But while the industry has established itself in the West, in Southeast Asia—specifically, the mobile game-loving archipelago of the Philippines—it is only in the nascent stages. In order to understand the impact esports can have on business, companies must first understand its foundational ecosystem, as detailed in this excerpt from the June 2021 YCP Solidiance white paper, The Next Level: The Rise of Esports in the Philippines.

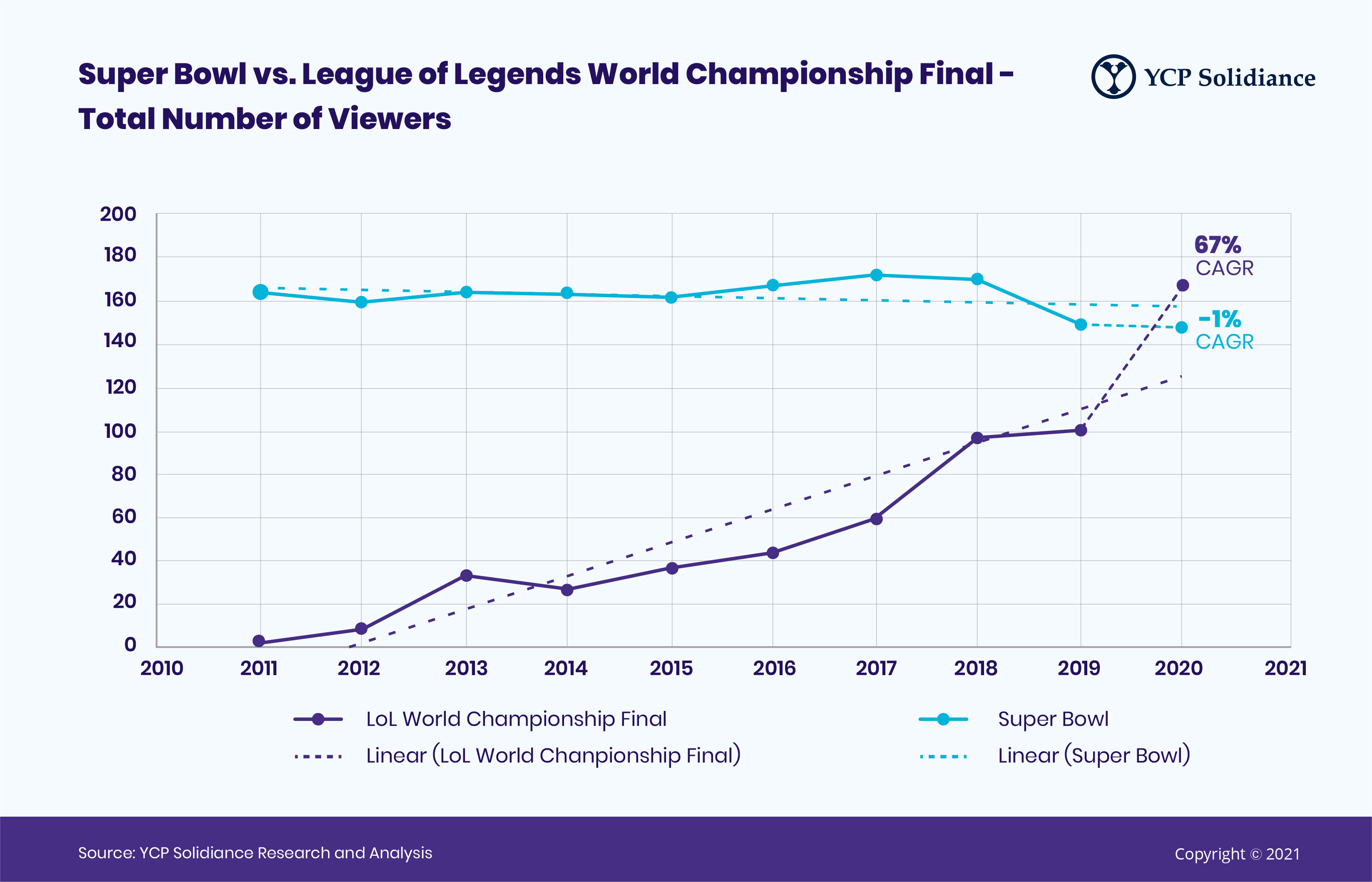

149 million people. That was the total number of viewers of the NFL Super Bowl Championship in 2019 according to Nielsen, making it the most watched American broadcast just before the COVID-19 pandemic hit.

However, consider another number: 100 million people. That was the total number of global viewers for the 2019 League of Legends (LoL) World Championship in Paris, according to statistics released by media. League of Legends is an esports game title published by Riot, who serves as both the organizer of the tournament and the producer of the broadcast.

Video games have come a long way from being viewed as a home entertainment system to finally evolving into a widely anticipated sporting event, a lot like traditional sports in many ways and metrics. Comparing the broadcast trends of the two aforementioned events for the past decade, it would have been quite possible—utilizing compound annual growth rate—that the total number of viewers for the League of Legends event in 2020 may have already exceeded the Super Bowl’s had it not been for the COVID-19 pandemic.

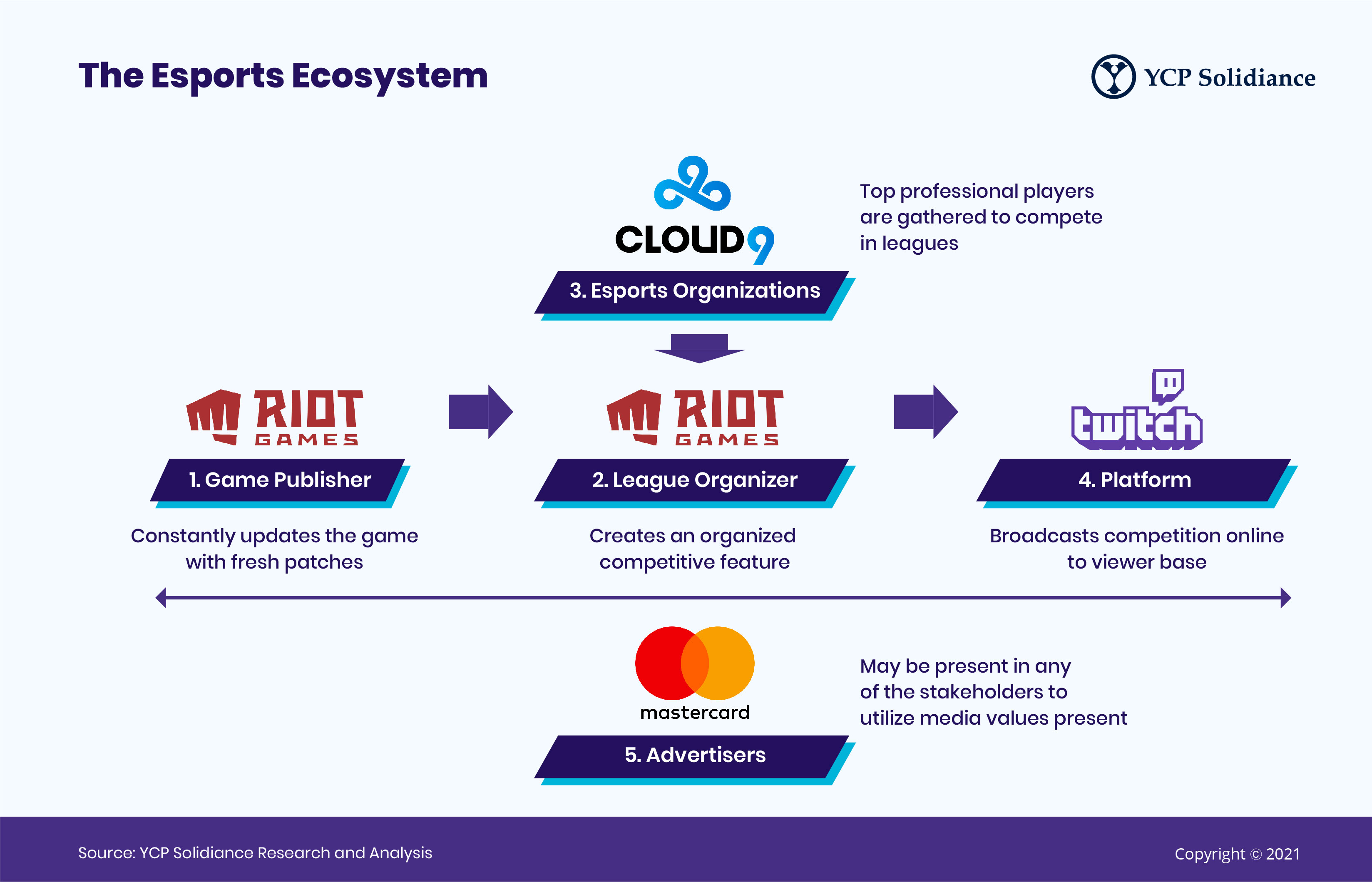

Esports are competitive video game events played in a professional league or tournament setting and are usually team-based in nature. But unlike traditional sports, the esports ecosystem is more complex and multifaceted with its own set of stakeholders, broken down into simpler parts via the diagram below:

The Esports Ecosystem

- Game Publishers are simply the developers of the video game. However, as an esports feature, the publisher releases periodic patches to add new game elements to evolve the playing experience and consequently, the prevalent strategies utilized in professional gaming. Examples of these game publishers are Riot Games, Blizzard Entertainment, and Epic Games.

- League Organizers, as the name suggests, produce the main tournament for professional-tier players of the game. Top leagues are usually shown to a live audience, and as such, sizeable investments are made to create sophisticated studios and to employ professional broadcast talent to deliver the competition play-by-play and enhance the overall viewing experience. For some esports titles, the developers themselves have diversified to also handle organizing flagship tournaments to have better control of the content being delivered, as is the case with Riot Games.

- Esports Organizations are the professional teams that participate in the leagues. It is common for esports organizations to establish teams in multiple esports titles under their brand name—for example, Cloud9, an American gaming organization, has 16 different professional teams and is valued at USD 350 million as of 2020.

- Whereas television is the main medium for most sports broadcasts, Esports Viewing is mostly online on livestreaming sites due to its digital-native audience. Amazon-owned Twitch and YouTube are some of the most popular platforms, and they have customized the viewing experience to cater to such esports events. They are primary broadcasters for many esports titles and have even signed contracts for exclusive distribution rights.

- Outside the operational interactions—but the lynchpin to the entire ecosystem—are Advertisers providing the main revenue source for the above stakeholders. Due to the notable viewership numbers, brands seek media values through association with esports entities or through running advertisements during airtime, much like traditional sports tournaments.

Global Esports Milestones

To illustrate just how far the world of esports has progressed, it is easy to cite and tout viewership numbers as the key figures to have trailblazed the industry forward. However, these instead should simply serve as the starting point, as even more crucial will be whether these viewership numbers convert into more investments pouring into the industry—and finally, whether the revenues will produce tangible returns to justify these purchases.

Investment amounts run deepest from game publishers, league organizers, and platforms precisely because these stakeholders are directly embedded into the ecosystem, which makes their investments inherently justified. It is through outside third-party investors coming in that shifts and evaluates public perception and monetary support for esports.

As far as third parties go, investments usually come in the form of creating esports organizations. However, running a pro esports team does not come cheap. For example, league organizers have confirmed that player salaries average USD 410,000 annually for pros in the League Championship Series (LCS), the professional League of Legends tournament in the United States.

Sizable salaries aside, professional teams also typically invest in large gaming houses to serve as lodging for players while doubling as specialized training grounds, supported by a full coaching staff. Some even have their own set of medical staff, physical trainers, nutritionists, and sports psychologists. Participating in leagues themselves also come with a price tag—for example, the cost to franchise a team for the Overwatch League (the highest tier of professional Overwatch, a first-person shooter game) ranges between USD 20 to 60 million.

Despite the incredible costs commanded by league organizers and game publishers, these have not deterred the public appetite for a cut of the esports potential earnings pie: the Overwatch League currently boasts 20 franchise teams, while the LCS and the League of Legends European Championship (LEC), which both feature franchising fees between USD 10 to 13 million per team, both have 10 teams respectively.

And still, there are hundreds more esports organizations around the world buying in early hoping to capture the great potential around them. Among them are investors like Michael Jordan, Drake, and even traditional sporting teams such as the Houston Rockets and Golden State Warriors.

Such investments however may be worth the price tag in a few years, as top esports organizations now earn upwards of USD 15 million every year according to Forbes. These earnings come from merchandising, revenue sharing from franchising fees, and most importantly, from sponsorships.

To illustrate, the likes of Mastercard, Coca-Cola, BMW, and Nike have been sponsoring esports leagues and organizations around the world. In fact, esports have been receiving so much brand support that according to research firm Newzoo, if not for the COVID-19 pandemic esports global revenues could have reached an estimated USD 1.1 billion in 2020, with USD 822.4 million coming from brand investments such as media rights, advertising, and sponsorships.

2020 was supposedly the first year the esports industry would break the USD 1 billion mark, showing 15.7% growth versus the previous year. 10 However, with the COVID-19 pandemic drastically affecting live events, the sector was found to have logged a -0.8% decrease to USD 950.3 million—a growth rate that is insignificant compared to many other sectors, and suggests a quick rebound from 2021 onwards. This is in line with thinking from stakeholders like Goldman Sachs, which generally reports a positive outlook for the global esports industry: a projected USD 2.92 billion worth of revenues by 2022.

To put simply, esports is no longer just an online phenomenon or a niche interest but a legitimate, growing sporting industry with hundreds of investors, sponsors, and advertisers. To note of its thriving, mainstream presence, non-gaming or non-endemic brands have been increasing in number, as The Esports Observer reported the following as early as 2019:

“Q1 2019 brought a surge of new esports partnerships from companies outside of the gaming space. The Esports Observer reported on 76 such deals between January and March—a 145% increase from the 31 deals reported on in Q4 2018, and also a 95% year-over-year increase over the 39 deals covered in Q1 2018. Not only did the sheer number of new non-endemic sponsorships rise, but the first quarter of the year also featured deals with prominent brands like Coca-Cola, AT&T, Honda, State Farm, and Nissan.”

Esports has finally evolved into a global ecosystem filled with tens of thousands of professionals spanning game publishers, event organizers, gaming organizations, and professional athletes. It is set to be a powerhouse industry for many years to come, with much of the revenue streams exponentially growing in figure every year.