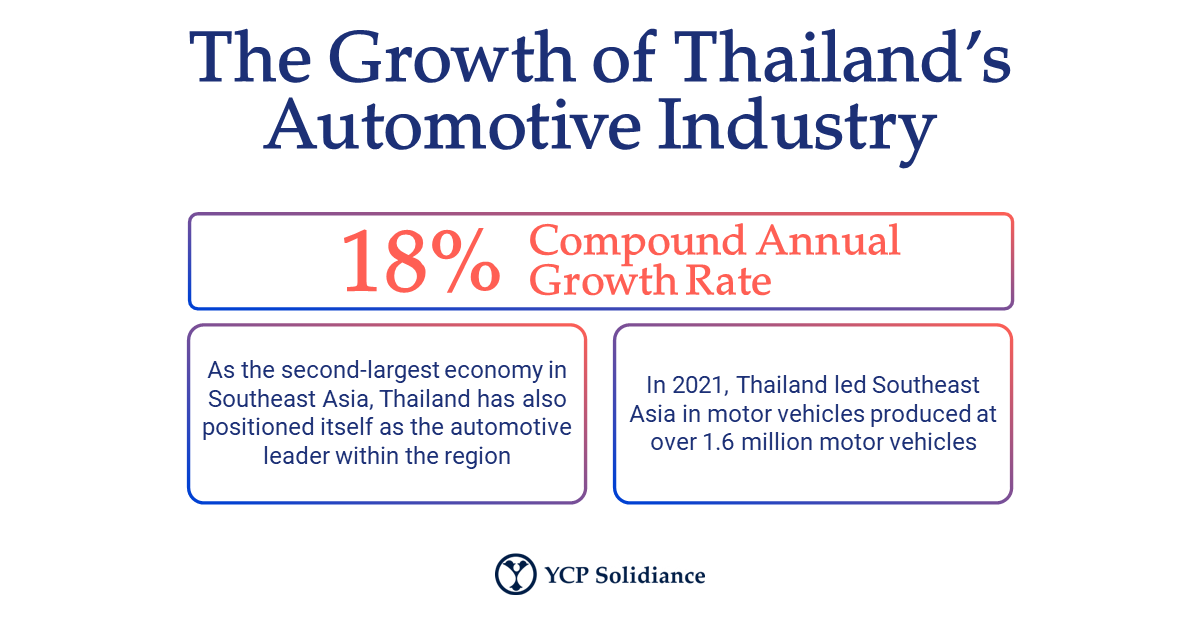

As per a report from ASEAN Briefing, Thailand boasts the second-largest economy in the Association of Southeast Asian Nations (ASEAN). One of Thailand’s most promising industries is the automotive sector, which performed well in 2021 as the country produced over 1.6 million motor vehicles– the most in Southeast Asia.

To capitalize on its position as an automotive hub in Southeast Asia, players situated in the automotive industry are now exploring ventures related to electric vehicles (EVs). Such a development presents several promising EV investment opportunities for foreign and domestic parties alike.

The emergence of EV investment opportunities in Thailand can be credited largely due to favorable government incentive plans for EV producers, such as reduced import tax for EV parts, excise tax cuts for imported EVs, and several subsidy programs. These incentives have facilitated the entry of international automotive powerhouses like Mercedes and Toyota, whose presence has further accelerated the automotive industry's growth and electrification.

Another important factor that has attracted EV manufacturers to Thailand is the country’s efficient automotive supply chains. Given Thailand’s previous successes in the automotive industry, wherein supply chains have played a significant role, indicators suggest that similar growth can be achieved for the country’s EV ambitions.

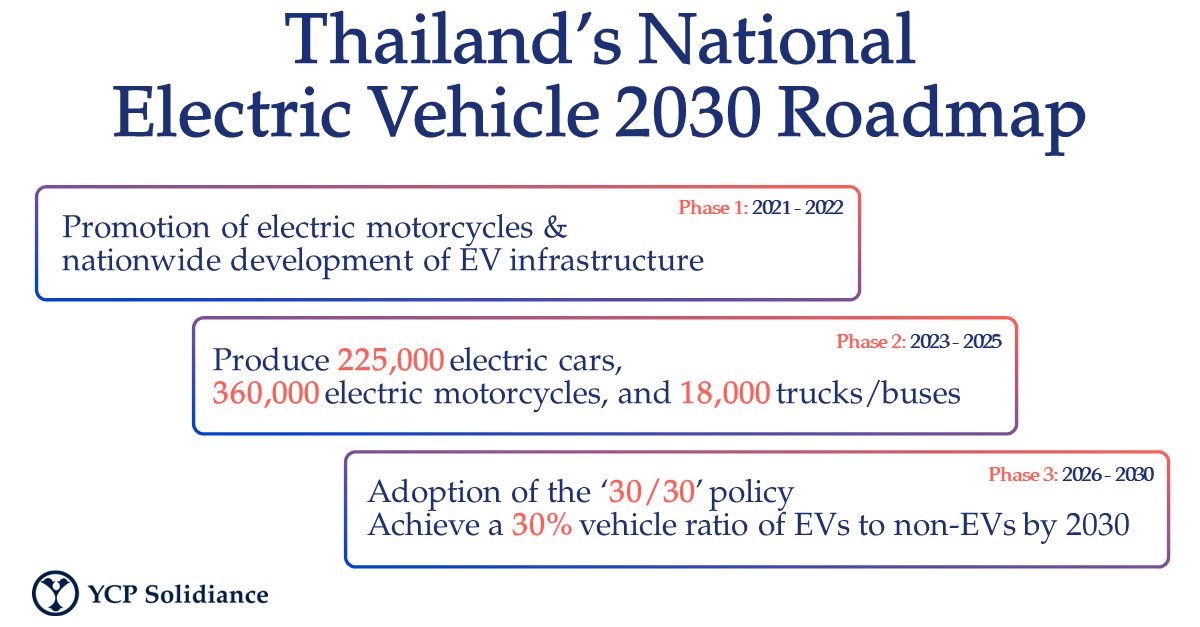

Further, parties from the private sector should also consider the public sector’s interest in growing Thailand’s EV market. As reported by Global Compliance News, the Thai government has passed several EV-related legislations that aim to stimulate market growth. Such policies include a three-phase national EV roadmap that aims to achieve a ‘30/30’ goal, which essentially means increasing the total number of EVs to 30% by 2030. These developments suggest that the public sector will emphasize public-private cooperation to catalyze EV-related investments. As such, interested stakeholders should actively explore partnerships within Thailand as the government will likely be more open to the entry of new players.

Market Outlook of Thailand’s Electric Vehicle Sector

Further, as the domestic EV landscape in Thailand matures, its success will lead to international partnerships between companies in Thailand and foreign entities. Instances of such deals have already taken place as Thai investment group, Egat International, entered an EV infrastructure development deal with US-based battery manufacturer Evlomo Technologies as per the Bangkok Post. Although the partnership is catered toward EV expansion in the United States, such deals will inevitably encourage investors to seek out related opportunities in the Thai market.

In the YCP Solidiance white paper “Electric Vehicle Development and Deployment in Thailand: Moving Towards an Acceleration of EV Adoption,” research shows that the EV value chain consists of several players, which ultimately creates more opportunities for market entry. For instance, the lack of dominant players in EV sectors like Installation & Maintenance (I&M) and Mobility Service Providers (MSP) means that there is still an opportunity for others to capitalize on the fragmented market. While this may create competition between foreign and domestic entities, the emergence of new competitors will ultimately benefit the outlook of the EV market in Thailand.

Moving forward, the automotive industry in Thailand is well-positioned to adopt the EV trend as the parties involved are proactively navigating market development. The entry of new investors from domestic and international players will help bolster ongoing efforts. All things considered, there are a plethora of EV investment opportunities in Thailand, and the industry will likely see sustained success in the coming years.

To get further insight into automotive trends in Asia, and the potential investment opportunities that stakeholders can capitalize on, subscribe to our newsletter here and check out these reports: