Vietnam is one of the fastest growing economies in Southeast Asia with 7.08 percent GDP growth in 2018, which was the highest among other countries in the region. Vietnamese government has successfully implemented export-based economy policies, resulting in the improvement of Vietnamese economic prosperity and consumerism. The rise of domestic consumerism is expected to help growing the country's various sectors, such as automotive industry.

Among many product lines of the automotive industry, passenger vehicles emerge to be the fastest growing product in Vietnam. Since 2012, Vietnam has been the fastest growing market for passenger vehicles in ASEAN. During this period, it grew at a Compound Annual Growth of Rate (CAGR) of 38%. The fast growing market has surely attracted the attention of many car manufacturers around the globe to enter this promising market.

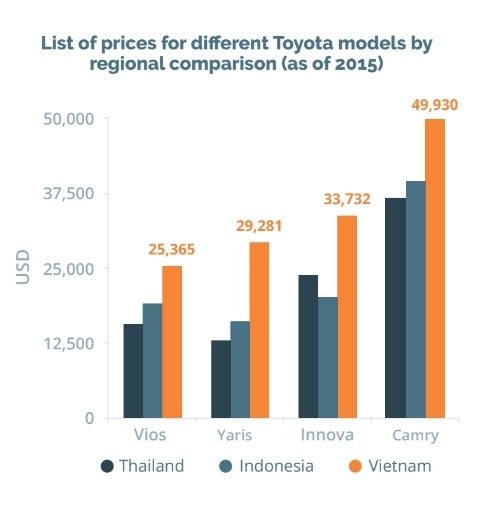

Vietnamese automotive industry is set to potentially grow in an amazing pace. However, there are a number of challenges faced by the Vietnamese passenger vehicle market to further develop. Vietnamese government has implemented a high taxes in order to reduce the nation's congestion and pollution problems, which mainly can be observed in Vietnam's big cities such as Hanoi and Ho Chi Minh City. The government also seeks to protect local passenger vehicle industry with the levied taxes and fees. This issue may be a drawback to the current fast-paced growth of passenger vehicle growth.

In 2017, the government has implemented a regulation which favored small engine passenger vehicles to lessen the CO2 emissions. The regulation imposed 40% tax on small engine passenger with engines below 2.0l, a 5% reduction from the previous tax policy. This tax is low when compared to passenger vehicles over 4.0l which are enforced with more than 100% tax. Different taxes by the Vietnamese government has led to the growth of small engine capacity passenger vehicle and the decline in big engine capacity passenger vehicle over the past few years.

The other challenge for Vietnamese automotive market is its own local automotive manufacturing. Following multiple efforts by the government, such as import fees and years of promoting local manufacturers, the local passenger vehicle industry remains limited and only provides 10%-30% of various Vietnamese car parts. The situation only worsened by the ASEAN members Completely Built Units (CBUs) tariff cuts down to 0% in 2018. Since then, local manufacturers have been reconsidering their business strategies in the Vietnamese market.

Vietnam is required to overcome these challenges in a timely manner, to unlock the opportunities of the fast-growing passenger vehicles market in the country.

Gain more insights on our full report, Driving Vietnam: Is Vietnam's Passenger Vehicle Market Shifting Gears?

Download White Paper