The Philippine has already taken massive strides towards becoming digital. Although 99% of payments are currently still made in cash, the country is transforming its payment landscape with the target to reach 20% of transactions done electronically by 2020.

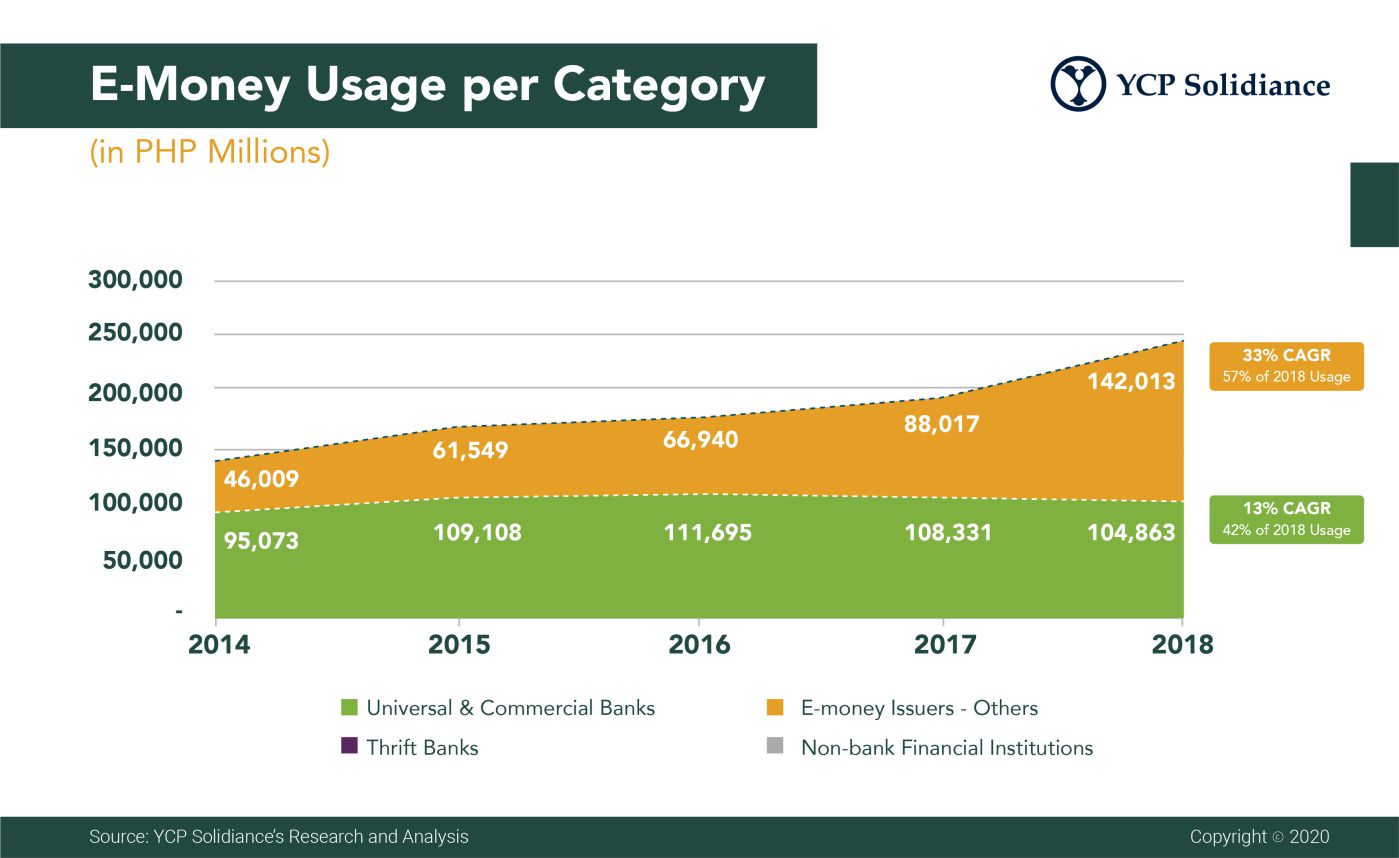

E-money is definitely being used more frequently in the country across the years. Its volume has grown steadily with an 8% CAGR in amount inflows and 15% CAGR for amount usage throughout 2014-2018. Transaction numbers have also seen sharp growth, boasting a 36% CAGR throughout the same period.

E-money is made accessible either through prepaid cards or mobile wallets. Major commercial banks in the Philippines already launched their prepaid cards, allowing them to access previously unaddressed segments of the population. Meanwhile, mobile wallet companies are leading the innovations and becoming an integral part of the e-money industry.

E-money has seen impressive growth in recent years, as its transaction is also projected to reach a value of PHP 370 billion by 2021. It is steadily changing the country’s payment landscape and influencing the payment behavior of Filipinos with regard to digital wallets. Given the positive trend, the Central Bank’s forward-thinking support, and the aggressive approach of the private companies, e-money will continue to see substantial growth in the Philippines for the next few years.