Although China’s haircare industry has gradually increased its value since 2013, the pandemic has dramatically accelerated the sector's development. Despite this growth and the emergence of active brands in the industry, the market still lacks a leading competitor, thus leaving an opportunity for domestic and foreign investors.

To capitalize on this promising market opportunity, investors should familiarize themselves with several aspects of China’s haircare industry, namely: growth, structure, and outlook. To get nuanced insight regarding the haircare market in China, read this excerpt from our latest white paper, Insights on China’s Haircare Industry: Japanese Brands in the Hair Color Market, which you can read in full here.

Due to rapid economic development, China’s disposable income per capita has doubled in the last ten years. This has brought China into a new period of consumption upgrades, shifting gradually from traditional living-based consumption to expenditure-based more on enjoyment. This shift is exemplified clearly by China’s haircare market, as consumers’ demands have increased and diversified, with the pursuit of healthy and beautiful hair becoming more important to consumers than just the basic necessity of keeping hair clean.

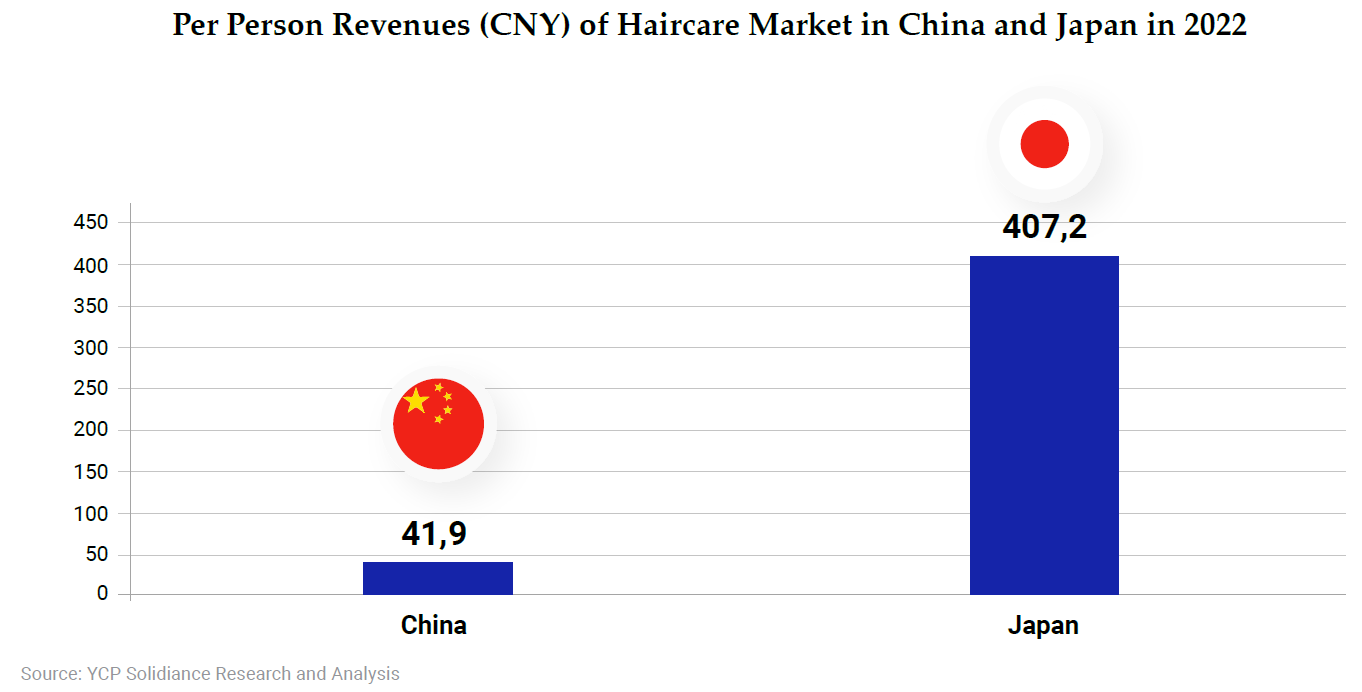

China is the second largest haircare market in the world, only after the United States. Japan is the third, with the overall market size between Japan and China quite close in number. However, China’s large population base makes the per person revenue of China’s haircare market still at a low level compared to Japan—in 2022, for example, Japan’s per person haircare market was valued at about 10 times that of China’s.

It can be deduced that China’s haircare market contains great potential—and as consumers’ purchasing power rises, so does the number of middle-class families in the country. This means the start of a new era of consumption upgrades, with more consumers willing to spend for higher-end products, including haircare. In this context, China’s haircare market is expected to grow both in size and premiumization, with a 5% CAGR through 2021~2025, and is expected to reach 70 billion CNY in total market size.

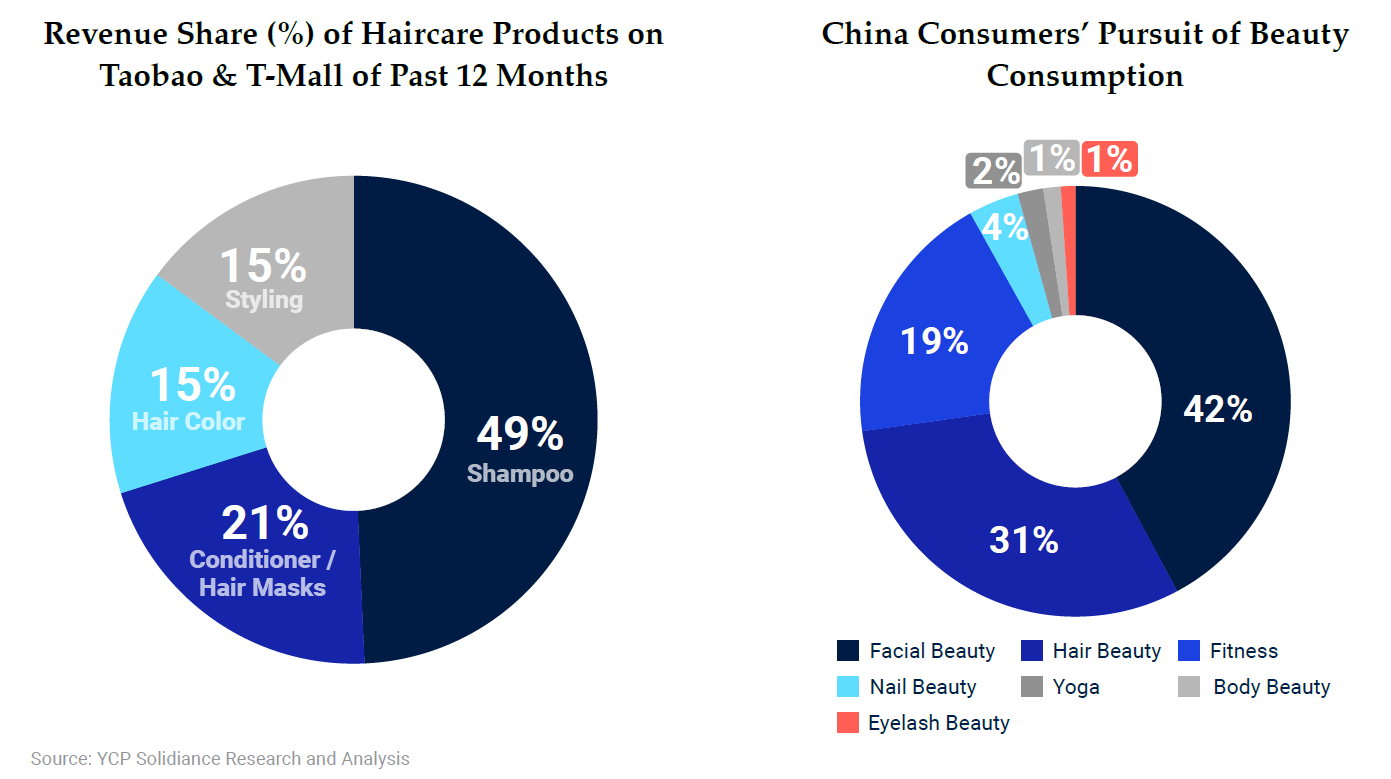

China’s haircare market can be divided into four segments: 1) shampoo, 2) conditioners and masks, 3) hair color, and 4) styling products. In terms of sales, online channels have been the major sales channel for haircare products, accounting for 70% of revenue share in 2020.

This report will focus specifically on studying the online channels for the haircare market, particularly China’s largest e-commerce retail platform Taobao (including its B2C offshoot T-mall), which accounts for more than 50% of the China market.

In the post-pandemic era, consumers have shifted their beauty needs from facial beauty care to including more of hair care as well. Due to the Chinese government’s strict zero-Covid policy, wearing masks is mandatory in public spaces, which has led to a decline in facial beauty needs as most of the face is covered. Consumers have turned to hair care, focusing on showing beauty through healthy and beautiful hair, which has correspondingly brought about the rapid expansion of the hair coloring market.

Secondly, older generations have become another growth driver for the market. In 2021, China’s over-60 population reached 18.9%, further highlighting the country’s aging consumers. At the same time, the aging employed population is also increasing rapidly, stimulating the demand for hair color among this group, as having black hair helps with looking younger and confidence in the job market.

To get further into insight other market trends across several professional industries in Asia, and how these developments will reflect in 2023, subscribe to our newsletter here and check out these reports: