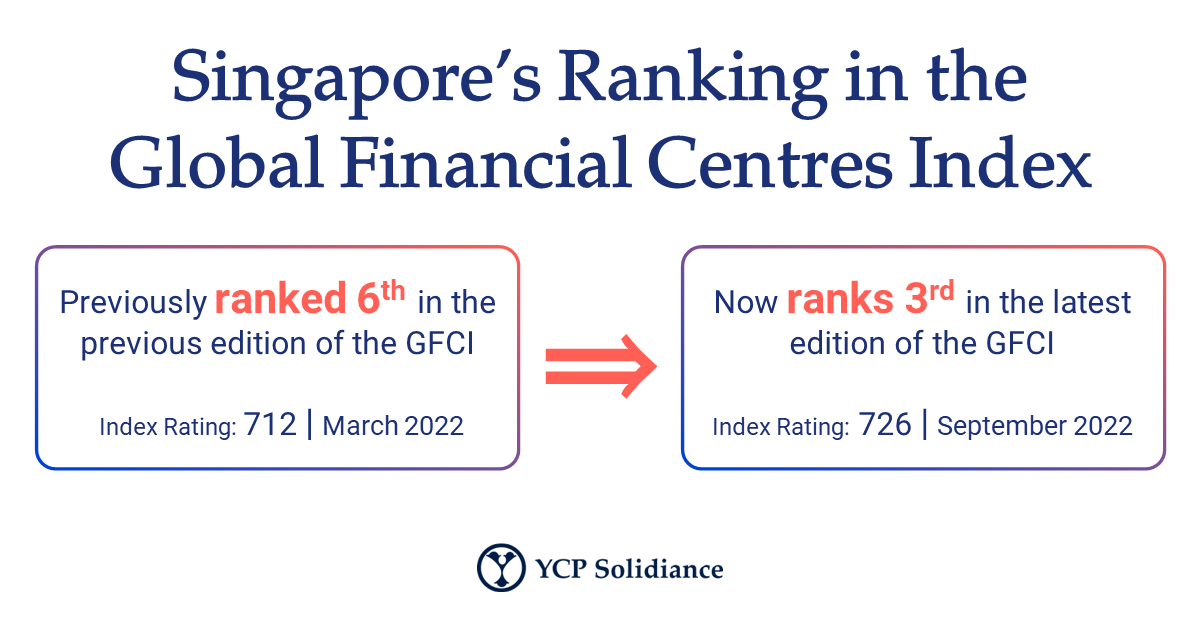

With Singapore successfully shifting to endemicity, many players have flocked to the country to explore business opportunities wherein industries like the financial sector have greatly benefitted. As per the September 2022 edition of the Global Financial Centres Index, a financial report conducted by commercial think-tank Z/Yen and the Chinese Development Institute (CDI), Singapore currently ranks third worldwide.

Such a development crowns Singapore as Asia’s leading financial hub, which will lead to a rise in demand and accelerated growth within the country’s financial services industry.

Although Singapore was already an important part of the global financial landscape beforehand, its recent emergence as the premier financial hub in Asia has led both the public and private sectors to capitalize by re-exploring related business opportunities.

To prepare for the incoming financial boom, the public sector in Singapore is taking steps to ensure that it is well-positioned to benefit from such growth. In September 2022, the Singaporean government launched the Financial Services Industry Transformation Map 2025– an initiative that will create up to 4,000 jobs in the financial services sector per annum over five years.

Moreover, Singapore has also become an attractive option for global financial industry players who are hoping to re-establish operations to achieve maximum efficiency. According to a June 2022 report by Channel News Asia, the American multinational investment bank, Citigroup, began to relocate senior staff and directors to Singapore for purposes of increased client coverage.

As more companies are expected to follow suit, this will eventually lead to an increased inflow of capital and financial talent in Singapore. Considering that this will serve to bolster the capability of the entire Singaporean finance sector, the financial services sub-sector will perhaps benefit the most as both domestic and foreign parties will re-direct their business towards Asia’s rising financial hub. In the context of the financial services sector, stakeholders will seek out investment advice and growth opportunities, which will likely lead to the exploration of other promising industries in Singapore like sustainability, healthcare, smart technology, etc.

Navigating Challenges Related to Growth

While both the public and private sectors are recognizing the nation’s potential as a financial powerhouse, the parties involved are proceeding cautiously as Singapore will have to ensure that it can cope with the challenges that come with the growth of the finance sector.

Of the potential challenges that Singapore will face, the most difficult will likely be balancing the interests of international entities versus that of Singaporean nationals. As foreign businesses relocate their manpower and operations to Singapore, the country will benefit from an influx of industry activity, but issues related to raised living expenses, scarcity of land, or quality of life, to name a few, will become relevant concerns to citizens.

To accommodate the interests of both international and national parties, the Singaporean government may need to offer incentives, such as varying tax exemptions across areas like property, luxury, income, etc. Further, the public sector may need to revisit national policies to help prevent future issues related to the influx of settlers within the country. For instance, as per a report by The Japan Times, Singapore’s finance minister recently announced that the government would be reviewing policy to help first-time home buyers secure properties due to rising concerns surrounding the expensive real estate market.

In the coming years, the finance industry in Singapore will inevitably continue its development. Although this growth will come with its own set of challenges, stakeholders should remain optimistic as the involved parties are acting with mutual benefit in mind. As parties navigate the financial landscape, public-private cooperation will also play a significant role in balancing domestic interests amid the entry of international players.