Managing the supply chain amidst the global pandemic COVID-19 has been more challenging than ever. Businesses in Vietnam have been impacted and manufacturing across different sectors has slowed as raw material sources, logistics, and the labor pool have been strained. Vietnam, posed as the future manufacturing hub following China, has its own way to respond to the situation - the government took a number of measures and released financial stimulus packages, among other solutions.

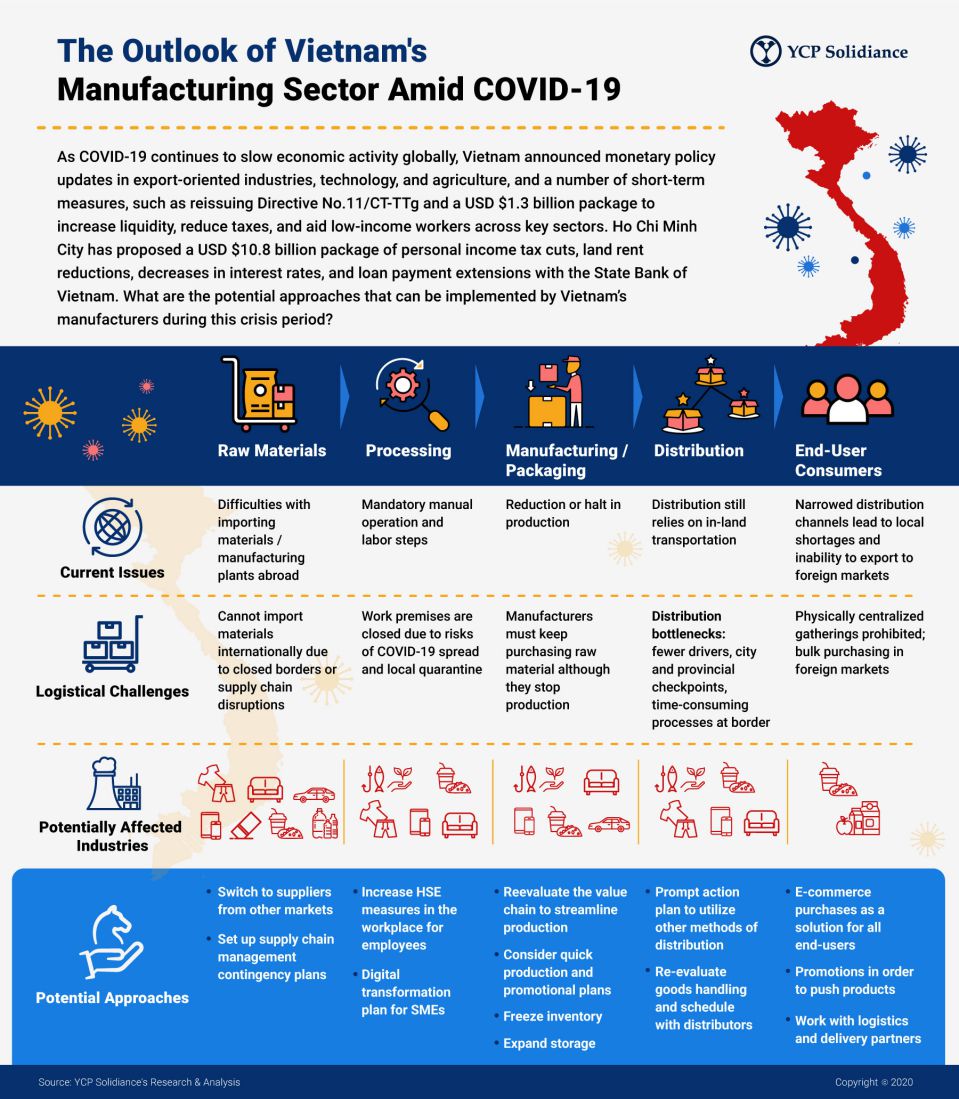

The current issues are challenging the entire supply chain in manufacturing, from raw materials to end-user consumers, as illustrated in the infographic below. Moreover, China, the epicenter of the virus outbreak, has become a world production center over the past two to three decades, affecting major industries and global manufacturing. Several potential affected industries include textiles and garments, F&B, furniture, electronics, rubber, plastics, automotive, agriculture/fisheries processing, and FMCG.

Potential Approaches for Manufacturing Players

Rather than awaiting a return to usual business, there are potential approaches manufacturers can look at whilst preparing for the long term impact. Our infographic below summarizes some of these below:

In terms of raw material, businesses should consider switching to suppliers from other domestic or international markets that are still available. This should be done to set up and organize their supply chain management contingency plans.

For businesses that still require manual labor and operation, it is strongly encouraged to increase health, safety and environment (HSE) measures in the workplace to protect their employees. Devising a digital transformation plan, such as a smart factory, is also a potential alternative to be considered for SMEs to reduce risks of COVID-19 spread.

Moreover, to address the challenges with raw material suppliers in the manufacturing and packaging stage, it is best to re-evaluate the value chain to streamline their production. This can be done by considering quick production and promotional schemes for domestic consumption, freezing inventory or even planning for expanding storage.

Distribution from ports and distributions centers still rely on in-land transportation, especially trucking. It is recommended to consider a prompt action plan to utilize other methods of distribution from first and middle-mile (e.g., river transport) to last-mile (e-commerce). Goods handling plan must be re-evaluated and scheduled with master distributors subsequently.

Lastly, to avoid risks from bulk buying, businesses should encourage e-commerce purchases as a solution both for domestic and foreign end-users, as well as promotions to push products. This can be carried out in collaboration with logistics and delivery, aiming to streamline product availability and tracking.

Supporting the Government’s Stimulus Packages

As COVID-19 continues to slow economic activity globally, the government of Vietnam has announced a number of measures and financial stimulus packages to aid small- and medium-sized businesses for the short-term including a reissuance of Directive No.11/CT-TTg on 04 March 2020 and a USD $1.3 billion to increase liquidity, reduces taxes, and aid low-income workers in a number of sectors. Monetary policies to help export-oriented industries, technology, and agriculture, such as dropping the state refinancing rate from 6% to 5%, discount rates from 4% to 3.5%, the cap on lending rates on these sectors from 6% to 5.5%, and the deposit rate from 5% to 4.75%.

Ho Chi Minh City, in particular, is also applying certain measures, such as personal income tax cuts for those in selected industries, land rent reductions, decreases in interest rates, and loan payment extensions in a USD $10.8 billion regulatory proposal with the State Bank of Vietnam.

For industry players, time to consider these key questions: how should the ideal supply chain look like? Which changes would likely last, and how would it affect your business in the long term?