Vietnam’s fintech industry has come a long way. As the country adjusts to a “new normal” brought on by the COVID-19 pandemic, digital payment services have begun to take center stage as more consumers are choosing cashless methods and digital options. According to an article by Vietnam News, 71% of consumers use e-wallets at least once a week, with mobile transactions set to increase by a whopping 400% by 2025.

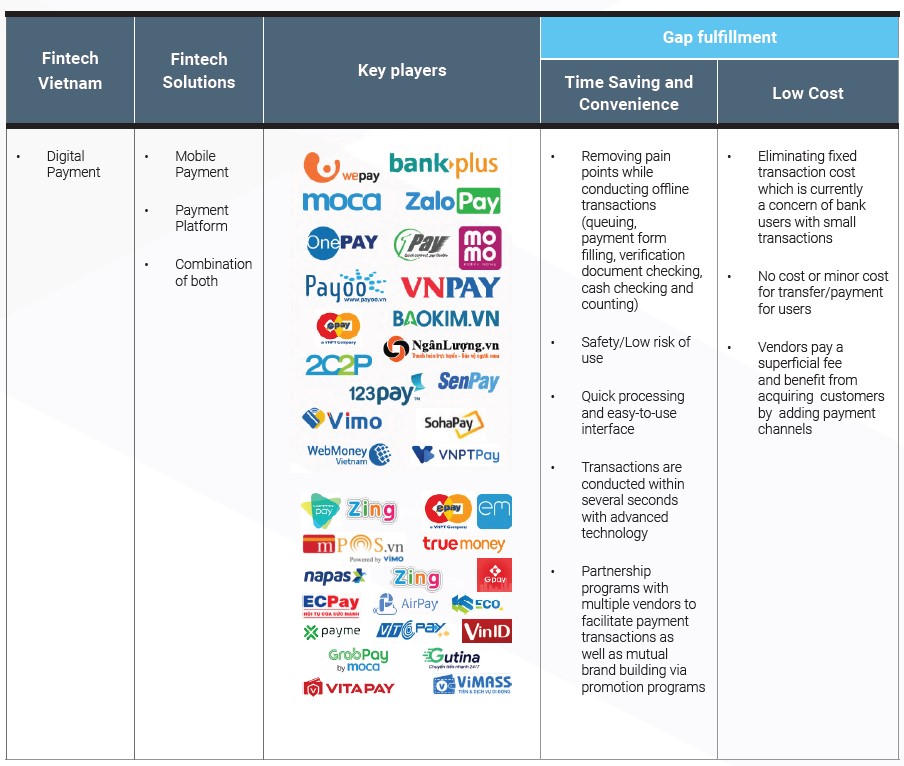

The growing popularity of e-wallets and other digital payment solutions have not gone unnoticed within the fintech sector—in fact, Singapore’s Fintechnews.sg reports that as of October 2020, the country now has 39 e-payment services providers, with more start-ups looking to join the fray.

According to the YCP Solidiance white paper Unlocking Vietnam’s Fintech Growth Potential, the different players within the industry can take this as a valuable opportunity to stake their claim on the market and revolutionize the nascent fintech landscape by understanding the different needs and growth drivers within the segment.

Opportunities in Digital Payments

Adding excitement to the fintech boom in Vietnam is a recent partnership inked between the conglomerate Masan Group Corp. and tech giant Alibaba. As reported in Bloomberg Asia, Alibaba and Baring Private Equity Asia are jointly investing USD400 million into Masan’s retail arm through a partnership with Alibaba’s Lazada e-commerce platform to make online shopping more accessible to Vietnam’s consumers.

With the growth of digital retail comes growth in digital payment, Vietnam’s largest fintech sector, as well. Consumers are now more inclined to use e-payment methods for their e-commerce transactions, and ingenious solutions are needed to stand out in the hyper-competitive digital payment landscape.

For players who want to invest in e-wallets, the following growth drivers are important to consider and strategize for in creating innovative new products:

- Fixed transaction fees with traditional banks have created a burden for consumers, who now prefer to use e-wallets to skirt around these fees.

- Surging smartphone and internet penetration among the population means more consumers are now interested in learning about digital technology and solutions.

- Vietnam’s low banked ratio leaves room for e-wallet services to acquire consumers not targeted by traditional banks.

A case study in the success of e-wallet innovation is the story of MoMo, Vietnam’s market leader in online payments that cater to both banked and unbanked Vietnamese consumers. Currently, the service boasts more than 23 million accounts and has developed a strong network of over 10,000 stores nationwide. Not only does MoMo offer traditional e-payments, it also provides bill payment services, mobile account recharge, and even personal loan settlement services.

MoMo’s diverse digital financial services and high-quality customer service have attracted investments from groups like Goldman Sachs, Standard Chartered, and Warburg Pincus—valued at over USD123 million.

Integration With Other Fintech Segments

Already Vietnam’s consumers are responding well to the efforts taken by digital payment providers and services: Cash on Delivery, the country’s major means of retailer payment, is expected to be surpassed by e-wallets as Vietnam’s economy, which grew 2.9% in 2020, continues to recover and grow even more. Vietnam News reports that last March, the government also made major strides in the acceptance of online payments with the approval and launch of ‘mobile money,’ which allows the use of mobile phone credit to pay for small goods and services.

But as digital payments become more mainstream, the need to integrate the other segments of fintech—Personal and Corporate Finance—becomes more defined. Digital financial inclusion should be the priority not just for fintech players, but for the government, to ensure accessibility for both consumers and SMEs. Read our full report here to learn more about the current fintech landscape in Vietnam and the opportunities that lie ahead.

For more articles and business insights, subscribe to our newsletter here.