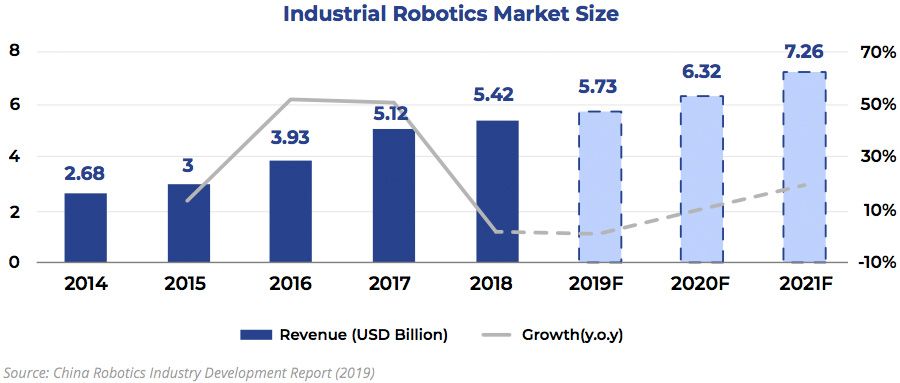

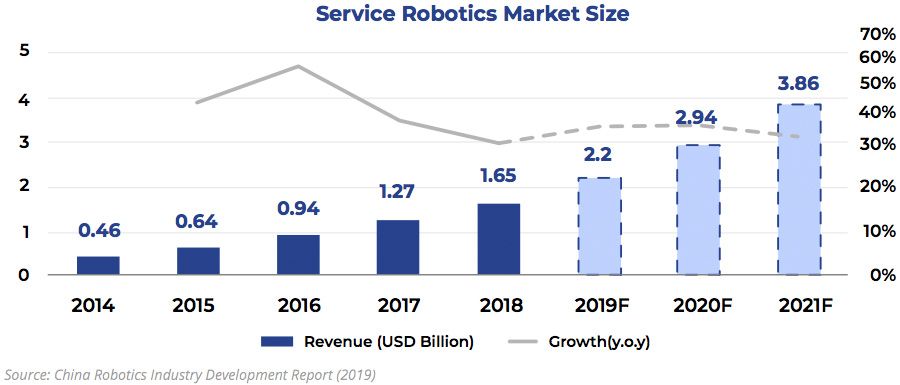

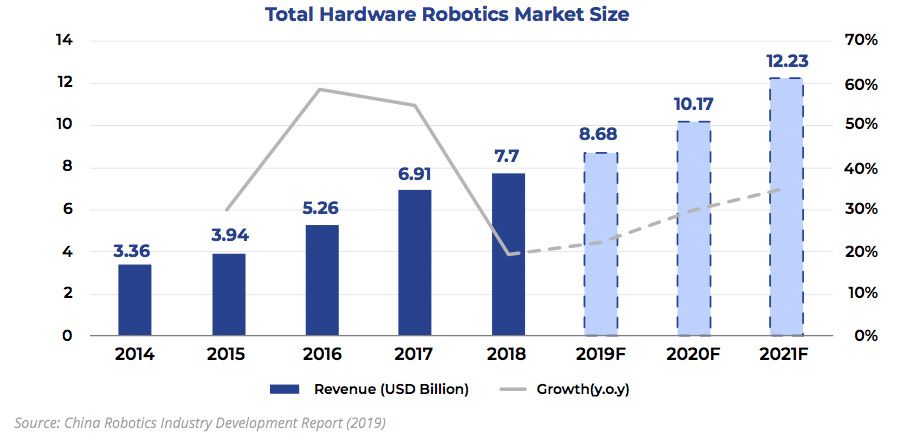

BEIJING, SEPTEMBER 2020 - On the whole, China’s $8 billion robotics sector is a global bright spot. The country’s installations of industrial robotics – which automate factory work – account for 36% of global installations. Service robotics – which automate services in the hospitality, healthcare and financial sectors, for instance – amount to a market of more than $2 billion in China, with growth of more than 30% in the year up to 2019.

No doubt, the Covid-19 crisis has slowed down this momentum to some extent. According to YCP Solidiance, an Asian-origin strategy consulting firm, the biggest blow to robotics growth in China has been the broad squeeze in funding on offer, driven by evaporating cash flows and widespread economic uncertainty.

Investments in China have plummeted by more than 50% since the start of this year, with the venture capital landscape taking the biggest dive. “China’s venture capital funding took a rollercoaster ride in the past two years. The total funding amount, which had reached a record high total deal value of $110.4 billion in 2018, slumped to $54.2 billion in 2019,” explained Ken Or, a YCP Solidiance Partner based out of the Hong Kong office.

While robotics in China have slowed as a result, the researchers also point out that there are some positives to take from the current circumstances. For one, economies have reopened gradually in recent months, and the outlook for many is looking more positive for the latter half of 2020 when compared to the first six months.

As the cogs and wheels start turning, so too will funding start to flow again. Investors will undoubtedly remain highly selective with their investments for the foreseeable future, although this might not be bad news for the robotics landscape. The report suggests that some segments of the robotics sector are actually highly lucrative for investment at this point in time, even if others are struggling.

ndustrial robotics, for instance, is a capital-intensive segment, which sets it up for a challenge under dwindling cash flows. At least in the short term, investments in automated manufacturing technology is likely to remain subdued. That being said, the segment might well be poised for a boom once money starts to flow again.

Disrupted supply chains and squeezed revenues led many businesses to the realisation that their manufacturing needs to be “smarter.” Technologies such as artificial intelligence (AI) and Internet of Things (IoT) are crucial to cutting costs, increasing efficiency and broadly de-risking the manufacturing process. Once cash builds up, industrial robotics is likely to get a tremendous boost as a result.

In the immediate term, meanwhile, the segment that is thriving is service robotics. During the pandemic, robotic technology has been used for myriad functions from remote health assessments and monitoring, to carrying out key business functions virtually. Going forth, YCP Solidiance points out that drone technology could be used to monitor crowd sizes, take temperatures or make food and product deliveries. The demand for service robotics, in short, is here to stay.

“Demand generated by the pandemic such as robotic solutions, online collaboration tools, tracking and detection systems, hygiene, and health care products will mostly stay due to increasing awareness of hygiene. And the use of robotics and automation technologies will continue to improve the operational efficiency and user experience, contributing to improve all aspects of our society and different industries,” explained Chloe Lam, a Director at YCP Solidiance in Hong Kong.

Sectors in focus

For businesses, this means opportunity. According to Solidiance, three sectors are currently faced with the biggest problems, but are also faced with the biggest opportunities to reinvent themselves. Manufacturing, hospitality and healthcare are the three sectors in focus.

For manufacturing, the biggest problems under the pandemic have been operational bloakcages and labour shortages due to lockdown. According to the researchers, industrial robots could easily continue production without putting labour at risk. Solving the immediate problem, such an investment would also bring more productivity, better capacity and more efficiency in the long run.

Hospitality has been affected by the sheer lack of travel during the pandemic, driven by enforced restrictions and fear of infection. Here, service robots could cut costs for hotels, and offer better capacity when tourism “rebounds” in the future. Long term, service robots could bring something fresh and new to hospitality, improving customer experience and keeping infection risks to a minimum.

Lastly, the healthcare sector is suffering from the excessive strain and risk on medical professionals. Service robots could take a lot of work off their hands, including disinfection, patrolling, monitoring and delivery. According to YCP Solidiance, China was already suffering from medical staff shortages before the crisis, so such help would only add value in the long term.